Facts about floods

No region of the United States is immune from flooding. Floods and flash floods happen in all 50 states.

Everyone lives in a flood zone. some are lower risk than others but even low risk areas cause substantial damage.

Most homeowners insurance does not cover flood damage and many people wrongly assume they do.

If you live in a Special Flood Hazard Area (SFHA) or high-risk area and have a Federally backed mortgage, your mortgage lender requires you to have flood insurance.

Just an inch of water can cause costly damage to your property.

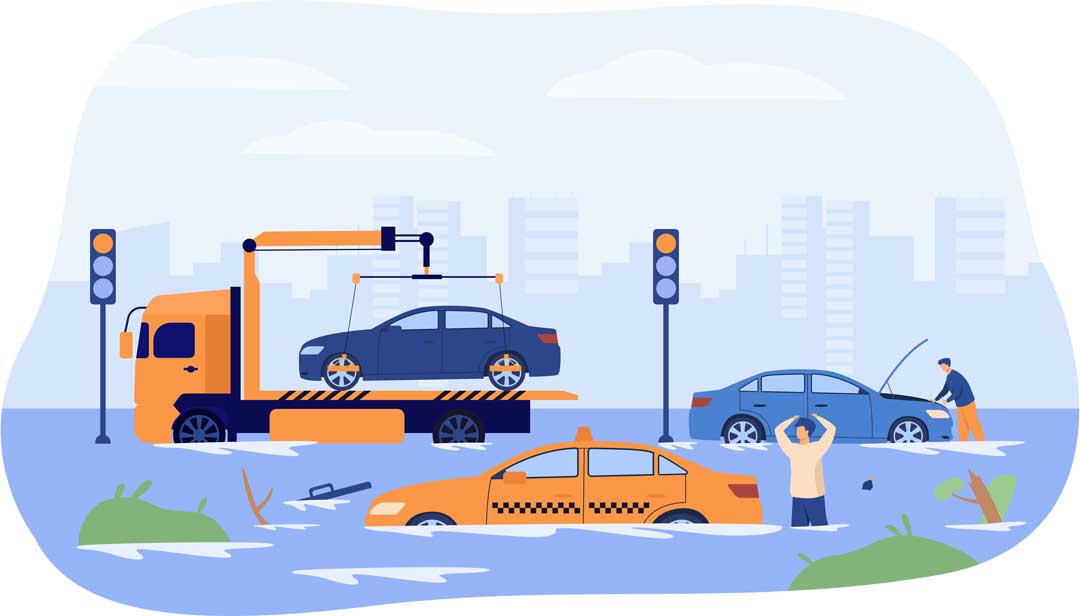

A car can easily be carried away by just two feet of floodwater.

New land development can increase flood risk, especially if the construction changes natural runoff paths.

New land development can increase flood risk, especially if the construction changes natural runoff paths.

Federal disaster assistance is usually a loan that must be paid back with interest. For a $50,000 loan at 4% interest, your monthly payment would be around $240 a month ($2,880 a year) for 30 years. Compare that to a $100,000 flood insurance premium, which is about $400 a year ($33 a month).

If you live in a moderate-to-low risk area and are eligible for the Preferred Risk Policy, your flood insurance premium may be as low as $300 a year, including coverage for your property’s contents.

You are eligible to purchase flood insurance as long as your community participates in the National Flood Insurance Program.

If you live in a moderate-to-low risk area and are eligible for the Preferred Risk Policy, your flood insurance premium may be as low as $400 a year, including coverage for your property’s contents. lower if you don’t require contents.

You are eligible to purchase flood insurance as long as your community participates in the National Flood Insurance Program.

It takes 30 days after purchase for a policy to take effect (FEMA), so it’s important to buy insurance before the flood waters start to rise. However, some private insurance carriers offer waiting periods as low as 15 days! We have access to these companies and can help you today! Call for a quote now!

In a high-risk area, your home is more than twice as likely to be damaged by flood than by fire.

Anyone can be financially vulnerable to floods. Over 20% of flood insurance claims are from areas outside the high risk flood zones and receive one-third of disaster assistance for flooding.

Last year alone will have over 45+ billion dollars in damage from Hurricane Sandy in the Northeast and Northern California.

Since 1978, the NFIP has paid over $36.9 billion for flood insurance claims and related costs (as of 12/31/10). That number is almost double after 2013.

Hurricanes, winter storms and snow-melt are common (but often overlooked) causes of flooding

Homeowner Association’s / Condo Associations / HOA’s

We can provide your master association with a competitively priced flood insurance policy. We work with property managers and directly with association boards to get the best rates for their homeowner association flood insurance needs. The RCBAP (Residential Condominium Building Association Policy) can cover eligible residential condominium buildings and commonly owned contents. Simply fill out our online form and we will prepare a quote for your HOA Flood Insurance needs.