The rules are changing for HOA’s and Master Flood Coverage. If you live in an HOA that is also in a high risk flood zone, you will soon be faced with some challenges regarding flood insurance. Here is a notice for one condo association we helped secure the right coverage at 40% less than FEMA.

FROM: The Board of Directors

RE: Flood Insurance

DATE: April 1, 2016

Dear Owners,

We want to bring to your attention some changes that may affect us as an Association and also each of us as individual owners at Bahia de Rafael. As the Board of Directors we feel it is our fiduciary responsibility to alert Owners of the FEMA change and possible risk these changes may have on us.

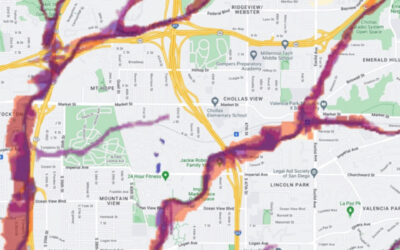

FEMA (Federal Emergency Management Agency) has remapped the flood zones in our area and Bahia de Rafael is now in the one hundred year flood zone. Also, the lending laws have changed related to properties in flood rated zones.

HOW DOES THIS AFFECT US?

- In the past Homeowner Associations were able to make their own determination whether to carry a master flood policy, allowing mortgage lenders to require the borrower to obtain an individual policy.

- Individual flood policies are no longer being written if an Association is in a FEMA flood zone.

- To be eligible for an FHA, Fannie Mae or Freddie Mac financing the Association must carry at least 80% flood coverage.

- Refinancing or lines of credit are no longer available without a master flood policy in place.

- Selling your unit to a resident owner will be limited. Selling to an investor will be easier; however, as the Association has less than 50% owner occupancy financing will be difficult without a private lender or an all cash buyer.

- Owners are selling at a 10-20% discount because owner occupant purchasers who require financing cannot buy in this complex.

WHAT DOES THIS MEAN?

Although the Board has the authority to obtain flood insurance without input from the membership, we traditionally put this issue on the ballot for a vote, which has been voted down.

Not having a master flood policy in place has left the common area “self-insured.”

The Board of Director’s plan for any emergency has been to obtain a loan and special assess the owners for funds needed to rebuild.

This is not possible any longer. Banks will not loan to an Association in a flood zone without flood insurance coverage. This would include obtaining a loan for any future maintenance issue the Association may require funds to complete a project.

If funds are needed then each owner would be responsible to provide the funds required through a Special Assessment.

WHAT IS THE ASSOCIATION’S PLAN MOVING FORWARD?

- We want to hold a Special Meeting of the membership to discuss these issues so everyone is aware of the situation.

- We will be obtaining a quote for a Master Flood policy so owners know the costs involved.

- Again, although the Board has the authority to purchase this insurance without Owner approval we want the members to share their thoughts and concerns at this meeting.

Although this may be a difficult financial responsibility for many owners, the Board believes it is in the best interest of the Association to obtain a Master Flood Policy.