By Aaron J. Farmer

Navigating Flood Zone X: Insights and Insurance Guide

In the realm of property ownership, understanding Flood Zone X’s implications is vital for accurately assessing flood risks to your property. Flood Zone X is a classification determined by the Federal Emergency Management Agency (FEMA) that identifies areas with varying levels of flood risk. Especially for Flood Zone X, which signifies a low-to-moderate flood risk, grasping the subtle distinctions within this category is essential for making informed decisions about flood insurance and property preparedness.

To better understand Flood Zone X and how it impacts homeowners, this blog post will explore the differences between shaded and unshaded zones, the importance of flood insurance, and proactive measures for flood preparedness. By the end, readers will have a comprehensive understanding of Flood Zone X and the steps they can take to protect their investments.

Understanding Flood Zone X

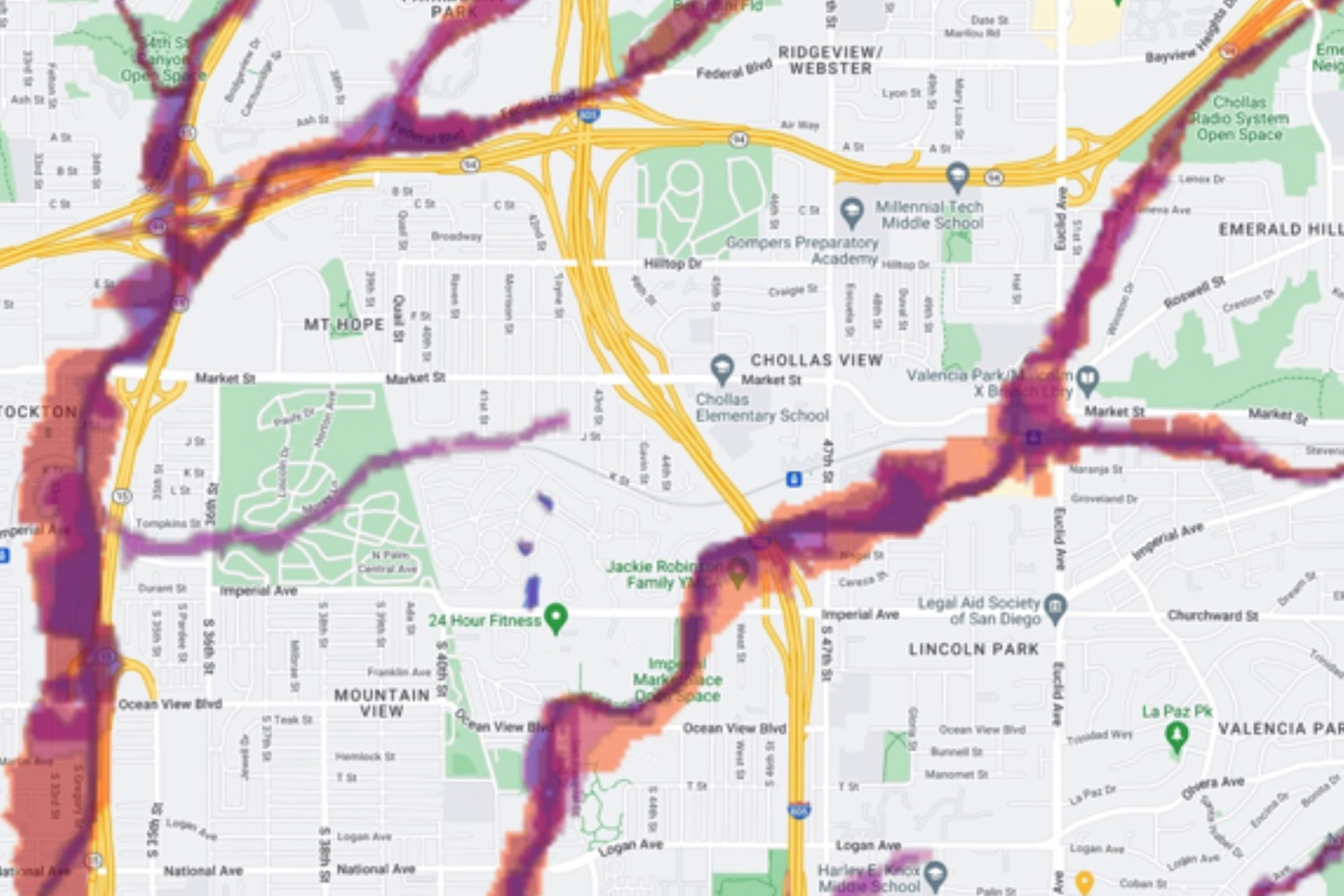

Flood Zone X is differentiated into two distinct types: shaded and unshaded, each representing a specific level of flood risk. The shading is seen when looking at flood mapping.

Shaded Zone X

Representing a moderate risk, properties in the shaded Zone X are located within the 500-year floodplain, outside the immediate 100-year floodplain. The annual flood risk in these areas is estimated to be between 0.2% and 1%. Despite being considered a lower risk, homeowners in these areas should not dismiss the potential for flooding. It’s advisable to consider the benefits of flood insurance as a protective measure against possible flood damage.

Unshaded Zone X

Areas classified as unshaded Zone X face a minimal flood hazard, with an annual flooding chance of less than 0.2%. These locations are situated outside the 100-year and 500-year floodplains, suggesting a lower likelihood of experiencing flood damage. However, it’s critical to acknowledge that no area is entirely exempt from flood risks. Factors such as environmental changes and local development can increase the risk of flooding, making it prudent for residents to remain prepared.

The Importance of Flood Insurance for Zone X

While FEMA does not require flood insurance for properties within Flood Zone X, homeowners should seriously consider it. Floods can happen unexpectedly, even in areas deemed low risk. The National Flood Insurance Program (NFIP) offers policies at an average cost of about $768 per year, but prices can vary based on several factors including location and property specifics. Private flood carriers often have rates as low as $350 per year!

Private Flood Insurance: A Competitive Alternative

Particularly for those in the lower-risk X Zone, private flood insurance emerges as a noteworthy option. Private insurers often provide more competitive rates for these lower-risk areas, potentially offering better coverage or lower premiums compared to NFIP policies. This competitiveness can be attributed to the lower risk associated with Flood Zone X properties, making private insurance a viable and sometimes preferable choice. Homeowners are encouraged to compare policies from both the NFIP and private insurers to find the best coverage and rates.

Proactive Measures for Flood Preparedness

Residing in a lower-risk zone does not eliminate the need for flood preparedness. Homeowners are urged to implement protective measures, such as installing backflow valves, utilizing flood-resistant materials in construction, and maintaining effective property drainage. These actions can significantly reduce the potential for flood damage.

Conclusion

Flood Zone X designation signifies a reduced flood risk but underscores the importance of being prepared and properly insured. Exploring both NFIP and private insurance options can ensure that homeowners secure the best possible coverage at the most advantageous rate. For comprehensive information on flood zones, insurance options, and preparedness tips, FEMA’s Flood Map Service Center and the NFIP website serve as valuable resources.

In the face of changing weather patterns and the inherent unpredictability of natural disasters, being informed, insured, and prepared is the best strategy for homeowners to protect their investments and achieve peace of mind.

Our agency represents multiple flood insurance carriers and can help provide competing quotes to help with your specific situation. www.californiafloodinsurance.com 855-225-3566.