By Aaron J. Farmer

Understanding Base Flood Elevation (BFE): A Crucial Factor in Flood Risk Management and Insurance

In the realm of property ownership, particularly within flood-prone areas, navigating flood risk management and insurance planning is indispensable. A pivotal component often encountered in this domain is the Base Flood Elevation (BFE). Despite its potentially technical facade, BFE’s role is paramount in how property owners approach flood risks and insurance premiums. This blog post aims to unpack the concept of BFE, elucidate its significance in flood risk management, and examine its influence on flood insurance policies, including insights into private flood insurance options.

What is Base Flood Elevation (BFE)?

Base Flood Elevation signifies the water level elevation resulting from a flood that bears a 1% chance of either being matched or surpassed in any given year, commonly termed the “100-year flood.” This designation, however, might be misleading as it doesn’t imply a once-in-a-century occurrence but rather a 1% annual risk.

Determining BFE

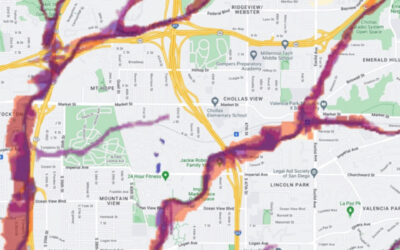

The Federal Emergency Management Agency (FEMA) is tasked with determining BFE for flood-risk zones, illustrating these levels on Flood Insurance Rate Maps (FIRMs). These maps categorize various zones, such as AE, AH, A1-A30, AR, V1-V30, and VE, each reflecting a distinct flood risk profile.

BFE’s Role in Flood Insurance

BFEs, alongside FIRMs, serve as critical tools for property owners, insurance agents, and lenders in determining flood insurance requirements and calculating policy premiums. The National Flood Insurance Program (NFIP), under FEMA, leverages BFE to delineate flood insurance maps, indicating mandatory flood insurance areas and influencing premium rates, with factors like property age and foundation type also affecting costs.

The Advent of FEMA’s Risk Rating 2.0

FEMA’s introduction of Risk Rating 2.0 marks a significant shift towards addressing rating disparities and furnishing a more nuanced reflection of flood risks. This innovative approach incorporates additional variables such as flood frequency, flooding types (e.g., river overflow, storm surge), and proximity to water bodies.

Locating a Property’s BFE

Determining a property’s BFE can be achieved by consulting FEMA’s flood maps, engaging with local building or zoning departments, or enlisting licensed land surveyors or engineers.

Construction Guidelines in High-Risk Zones

FEMA recommends that constructions in high-risk flood zones exceed the BFE by at least two feet, a guideline aimed at mitigating flood damage risk. For zones lacking a specific BFE, collaboration with community officials to establish a site-specific BFE is vital.

The Edge of Private Flood Insurance

A noteworthy aspect of flood insurance is the emergence of private flood insurance options, which also use BFE in their risk assessment and premium calculation. Notably, private flood insurance may offer lower premiums than those provided by the NFIP. This alternative presents a compelling option for property owners seeking cost-effective solutions without compromising coverage quality. By leveraging BFE, private insurers can tailor their policies more precisely to the actual risk level of properties, potentially offering more competitive rates and coverage options that better suit individual needs.

Conclusion

The intricacies of BFE in property development, insurance planning, and flood risk management underscore the importance of a thorough understanding and application of this concept. Whether through NFIP or exploring private insurance avenues, incorporating BFE into flood risk management strategies is essential for effectively safeguarding properties against flood-related adversities. As we navigate the complexities of flood insurance, the knowledge of BFE and its implications stands as a beacon for property owners, guiding them towards informed decisions and optimal protection strategies in the face of flood risks.

To get BFE Information or to get a quote on flood insurance please contact us at 855-255-3566 or service@californiafloodinsurance.com