Just a few inches of water entering your premises can cause massive damage to your property or create havoc in your home. Whether you live in a high risk area or low risk flood zone, you are vulnerable to flooding, which could cause loss of thousands of dollars, drain out your savings, or even leave you bankrupt, in the absence of a flood insurance policy. The most practical way to get compensated for all the damages is through a flood insurance policy.

Being a homeowner or renter, you must protect your property from natural disasters that might strike in your area anywhere. Since almost all types of property insurance exclude floods, the best way to safeguard your property from floods is by securing flood insurance through the National Flood Insurance Program, which was set up specifically to protect local communities from economic difficulties posed by floods. The NFIP, under an agreement, works in partnership with local communities to offer federally sponsored flood insurance coverage. If your community does not participate in the NFIP or to get a more comprehensive coverage, get a flood insurance policy to find the best protection.

Flood insurance covers your house and personal belongings inside your home from flood damage. While evaluating flood insurance quotes, find out the differences between water damage from floods and regular water damage. The homeowner’s policy might offer coverage for water damage from a swollen or burst pipe, not from a flood. Therefore, it is important that you buy additional insurance coverage for flood damage even if your current policy states it covers water damage.

Purchasing Flood Insurance

You can purchase flood insurance from a local agent in your area. The agency must be a recognized member of NFIP to offer flood coverage. Our agency specializes in flood insurance. You may contact us anytime to provide a flood quote. While reviewing flood insurance quotes, check the limits on the coverage, as some policies become effective in 30 days. Some private carriers have waiting periods that are as low as 15 days. If a flood strikes within the 30 days, you might not be covered. Determine if the coverage is sufficient to rebuild your home if it is destroyed or damaged in flood.

Remember, Flood Insurance coverage can provide coverage worth $250,000 for your home and $100,000 for your belongings. Excess Flood coverage is available for amounts needed over those limits.

Protect Your Home, Family

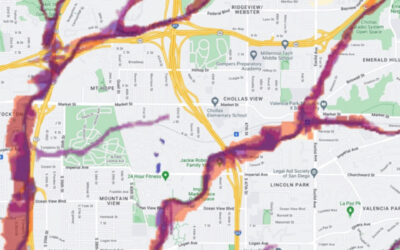

Many of the flood insurance policies are very affordable. The purpose of buying the insurance is to not only get compensated for damages, but also to clean up your home. The cost might be higher in a high risk area, such as A and AE flood zones. However, remember that it is worth investing in flood insurance to protect your home and family than rebuilding your home that has been devastated by a flood. Contact us immediately for a flood quote today. Toll Free 855-CAL-FLOOD.